Steve Schifferes, City, University of London

The UK government’s widely trailed announcement that it will increase national insurance taxes by more than one percentage point to fund reform of the social care system and help fund the NHS has triggered a fierce political debate. Many Conservatives are furious that it means breaking an electoral promise not to raise taxes, while other people, especially on the left, argue it is unfair to tax the young and relatively poor to help older, wealthier pensioners who own their own homes.

Beyond this controversy, there are much broader issues at stake about the future of the UK’s welfare state after a decade of austerity and the ravages of the pandemic. The social-care row is the opening salvo in a debate which will rage until later in the autumn when Chancellor Rishi Sunak announces his comprehensive spending review, which will set the course for the next general election.

Austerity lite?

The problem for the Conservatives in securing their election victory in the “red wall” constituencies, which used to reliably vote Labour in the north of England, is they are somewhat beholden to them. The government has made promises to its new working-class voters to “level up”, and to impose no more austerity.

Boris Johnson also pledged to reform social care during the 2019 election, to improve a system that requires most people to sell their houses to pay for care in old age despite having paid taxes all their lives. This will cost over £10 billion a year.

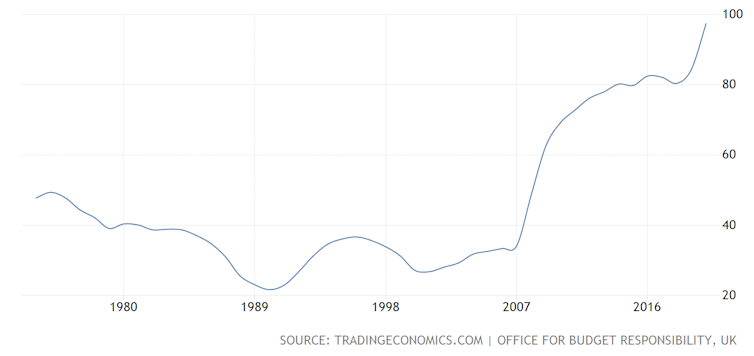

Yet the chancellor has set out a tough set of fiscal targets to tackle the huge budget deficit built up during the pandemic. The government has racked up a debt of £2.2 trillion, which equates to the size of the entire UK economy. How does it square the circle?

UK net debt as a % of GDP

So far, Sunak has managed to reassure the public that he is on their side while demonstrating to the markets that he won’t be a soft touch. He signalled in the March 2021 budget that he will put up taxes to meet his targets, announcing higher taxes on companies from 2023. This was met with relatively little criticism and proved popular with the public, and the same is true of the proposed rise in national insurance.

But more importantly, the chancellor has made it clear that less visible parts of public spending will be hit hard to keep the finances in check, freezing public-sector pay in the 2020 spending review. And despite reluctantly granting extra money for nurses in 2021, public-sector pay – which comprises one-third of all spending – seems likely to again be curtailed.

Meanwhile, Sunak has asked all government departments to make 5% “efficiency” savings and cut staffing levels. And though the government is committed to high-profile spending on health, education and defence, these departments may not get enough to restore spending to pre-austerity levels, while less favoured ministries may well suffer further cuts in real terms.

The chancellor has been particularly careful not to make any long-term spending commitments to non-departmental spending, such as a permanent increase to universal credit. Indeed, he is also potentially preparing the ground for permanently scaling back pensioner benefits.

Shortly after the announcement on social care, Sunak is expected to temporarily suspend the so-called “triple lock” on the state pension, another manifesto commitment. This stipulates that pensions rise each year at 2.5%, or in line with either the rate of inflation or average earnings, depending on which is the highest. Again, political uproar seems inevitable.

Meanwhile, the funds actually allocated to the regional “levelling up” agenda are extremely modest, with headline-grabbing proposals for freeports, but only a small amount of discretionary spending to improve town centres and deprived areas.

A lucky chancellor?

The chancellor’s immediate challenges have been eased by the economy recovering quicker than expected from the pandemic. This has reduced spending and boosted revenues by some £25 billion, which may reduce the immediate squeeze on spending.

And one consequence – a sharp rise in inflation – has also temporarily helped Sunak. Wage inflation will push more workers into higher tax bands, increasing tax receipts further, and higher prices will mean more VAT returns. Inflation also reduces the value of the public debt in real terms.

For the future, a combination of stronger growth and modest inflation will be the most effective way of meeting the chancellor’s key target of stabilising the debt-to-GDP ratio, and so reassure the markets. But if inflation rises more rapidly, the Bank of England may raise interest rates, which could increase the cost of servicing the huge government debt. At present, the interest rate paid by the government on its debt currently at its lowest level in over 300 years.

However, despite the recent helpful economic numbers, the UK (and many other countries) are at a crucial turning point in the role of government. The future needs for public spending are likely to be much greater than before, and postponing decisions on tackling them will make the ultimate cost much greater.

The first challenge is tackling the economic legacy of the pandemic, and the damage caused to businesses and individuals, as well as government services. Second is to tackle the continued fall in UK productivity since the economic crisis of 2007-09. This has caused wages to stagnate, exacerbating the gap between rich and poor, and contributed to the political malaise that saw Conservative victory in 2019.

Even more serious, the UK has an ageing population. This will put a further strain on the public finances, necessitating much higher spending in health and social care than is currently proposed, and also hitting pensions (public and private).

Finally, the government must finance the rapid decarbonising of the economy to prevent catastrophic climate change. This is something that Sunak has shown little predilection to do, despite the UK hosting the COP26 summit in November.

Rishi Sunak has demonstrated a real political savvy in these difficult times that may well boost his chances of succeeding Boris Johnson as prime minister and ensure a Conservative victory in the next general election. But his real place in history will depend on how he responds to the extraordinary challenges of the age. Winning the argument over higher funding for social care is important, but it’s just one of many financial conundrums that the government has to overcome.

Steve Schifferes, Honorary Research Fellow, City Political Economy Research Centre; Professor of Financial Journalism, 2009-2017, City, University of London

This article is republished from The Conversation under a Creative Commons license. Read the original article.