Flights facilitated by the Australian Government to return Australians from India have resumed, with the first aircraft arriving in Darwin today (Saturday) from the city of New Delhi.

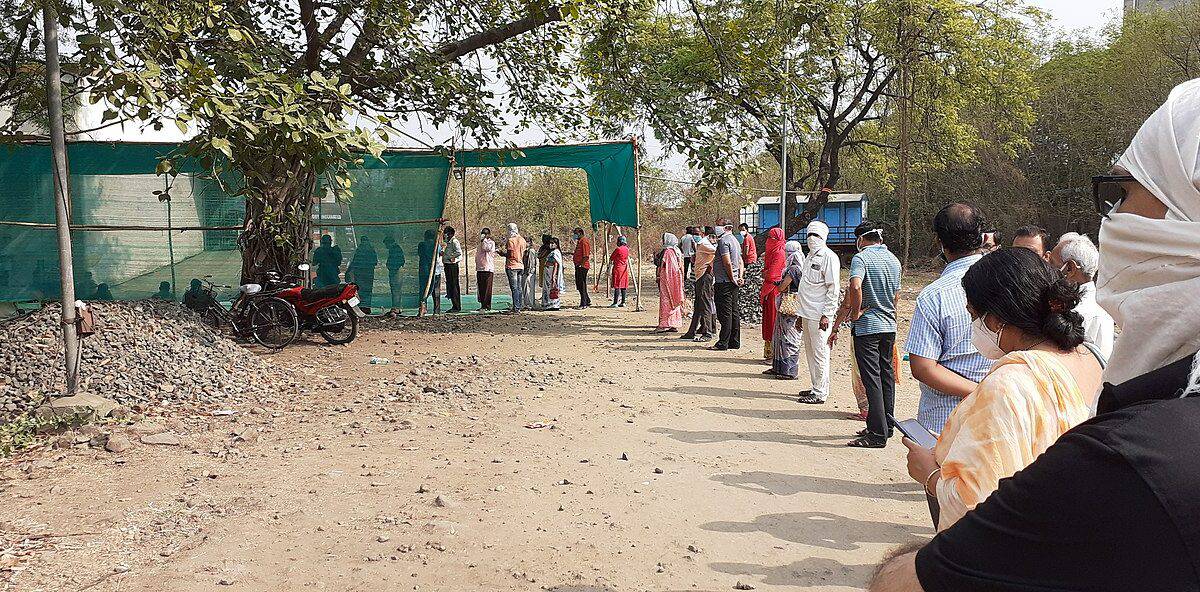

The passengers – the first to arrive since the Federal Government controversially banned Australian citizens in India from returning home – will quarantine at the Centre for National Resilience at Howard Springs in the Northern Territory.

All travellers will undergo PCR and Rapid Antigen Testing before they will be allowed to travel within the country.

The aircraft carrying the first group departed to India on Friday from Sydney, loaded with further life-saving oxygen equipment to support the Indian Government and NGOs in their struggle to respond to the Covid-19 crisis in that country.

Temporary pause helped to mitigate the risk

Foreign affairs minister, Marise Payne, said the temporary pause in arrivals had helped mitigate the risk of potentially higher rates of infection presenting on arrival in Australia and ensured the country’s quarantine system was able to receive further flights.

“These government-facilitated flights will be focused on returning Australian citizens, residents and families who have registered with our High Commission and consular offices within India and will prioritise the most vulnerable people,” she said.

According to Payne, the latest flight into Darwin brings the total number of government-facilitated commercial flights from India to 39. These have returned more than 6,400 Australians since March 2020.

The next government-facilitated commercial flight from India is expected to arrive in Darwin on 23 May. Arrangements for further flights into Australia are underway.

Fifteen tonnes of supplies have been delivered

Meanwhile, Australia has now delivered over 15 tonnes of medical supplies to India, including more than 2,000 ventilators and 100 oxygen concentrators.

Health minister Hon Greg Hunt said the Government stood ready to offer further emergency medical supplies if requested by the Indian Government.

“The Australian Government is committed to doing all it can to support the Indian Government’s response to the Covid-19 pandemic,” he noted.

Payne also praised the response of Australian businesses and everyday Australians, and welcomed the support offered from state and territory governments.