James Meese, RMIT University; Edward Hurcombe, Queensland University of Technology, and Francesco Bailo, University of Technology Sydney

Not so long ago, Facebook was a goldmine for Australian news media. News featured prominently in Australians’ Facebook feeds, and newsrooms across the country saw a growing online audience engage with their stories.

People were liking, commenting and, most importantly, sharing stories, delivering new eyeballs to news outlets. This revolution in news distribution encouraged many of Australia’s biggest news media companies to invest time and money into posting on Facebook.

But the relationship between Facebook and news companies has soured. Facebook famously changed its algorithm in January 2018 to reduce “audience exposure to public content from all pages, including news” in favour of posts from family and friends.

Many news media companies (including The Conversation) responded by embracing alternative tactics, such as subscription campaigns, to reach readers directly. But some digital outlets that had lived their entire lives in synergy with Facebook could not adapt to this new environment, and had to lay off staff or reduce their operations.

While commentary during this period, and Facebook’s own updates, suggested that news content was no longer as prominent on Facebook, there was no hard data to see if this was actually true, particularly at the national level. So we decided to investigate how the Australian news sector performed on Facebook during this upheaval.

We began by building a sample of 32 national and metropolitan news organisations. We then used the Facebook-owned CrowdTangle database to collect engagement data from these organisations’ Facebook pages. Our data set included more than 2 million unique posts, from January 1 2014 to December 15 2020.

Next, we constructed a daily performance score for each news organisation’s page during this period. We removed the 25% best and 25% worst-performing posts, and averaged the remaining 50% across 30-day rolling intervals. We did this three times — once for each of the three dominant Facebook metrics: reactions (likes, hearts and so on), comments and shares.

Finally, we divided it by the “baseline average” from January-April 2017, which is in the middle of our data set. This means a score of 1 would represent the baseline average, whereas a score of 2 would mean performing twice as well as the baseline, and 0.5 only half as well.

We wanted to see whether our analysis can explain why Australian news organisations had begun moving away from Facebook. We also wanted to see whether some news organisations have been hit harder than others by the dramatic changes Facebook made to its algorithm in recent years.

A peak and then a collapse?

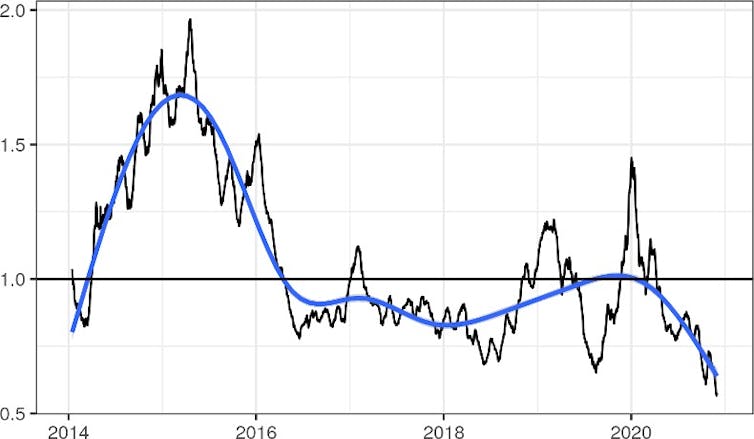

The first headline finding from our analysis is that in terms of engagement, Australian news content experienced a clear period of success on Facebook before a subsequent reset. This is especially so in the case of the number of user “reactions” to news content, shown below for the entire sector.

Sector-wide reactions to news content

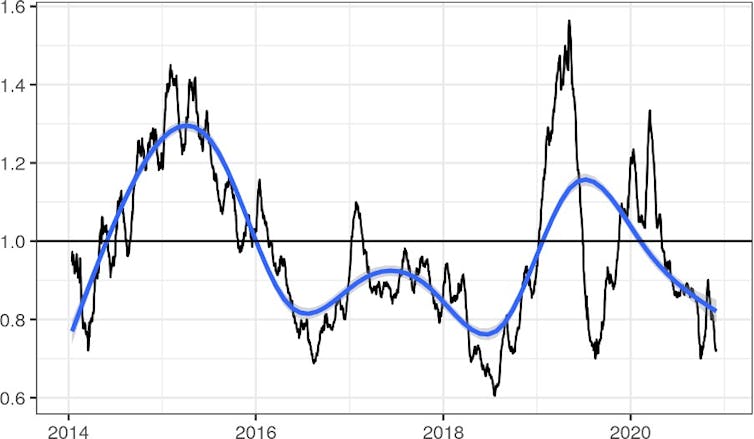

It was a similar story when we looked at “shares” across the whole sector:

Sector-wide shares of news content

Sharing of Australian news content peaked in 2014-16, and then declined towards the end of the decade. Remarkably, the sharing performance score in November 2020 was only 15% of the score measured in November 2014. This is striking, because at one stage news sharing was seen as central to the Facebook experience. Clearly, that no longer seems to be the case.

Comments, however, tell a different story. For the sector as a whole, comments peaked near the end of the decade, in May 2019.

Sector-wide comments on news content

The simple narrative of a peak and then a collapse is clouded still further when we look at specific news outlets. While we identified an overall decline in Facebook engagement with Australian news, there have been winners and losers.

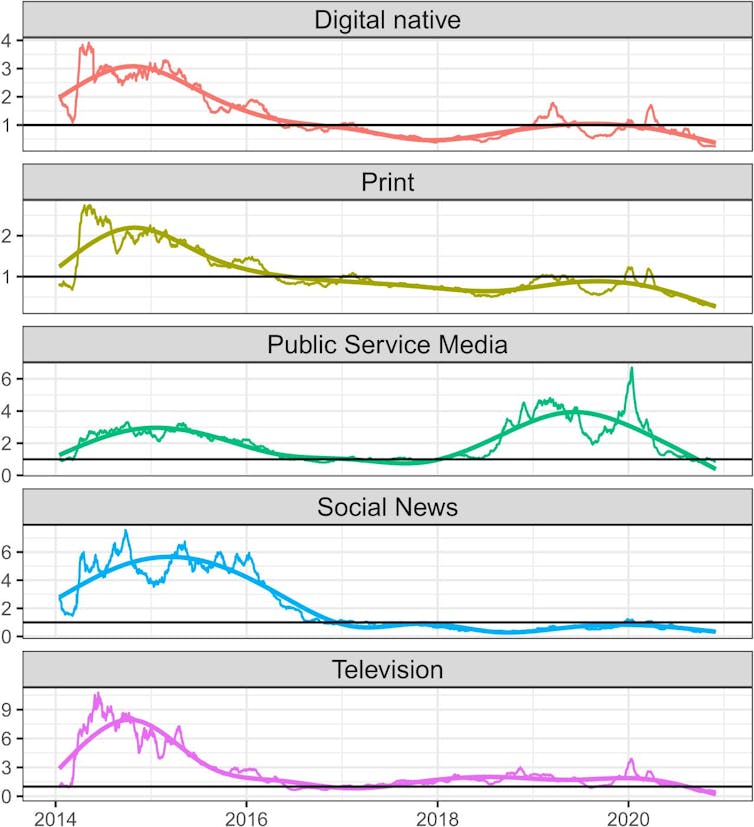

The most dramatic fall afflicted digital-native youth outlets such as Junkee, Pedestrian and BuzzFeed, whose reaction performance scores dropped from 3.9 in January 2016 to 0.18 in late November 2020. The sharing score for these outlets also fell dramatically, from a high of 5.8 in November 2015 to 0.4 at the end of 2020.

In contrast, public service outlets the ABC and SBS rebounded towards the end of the decade. Their comments, reactions and shares rose after Facebook’s 2018 algorithm change and only recently returned to our 2017 baseline in late 2020.

Number of shares, segregated by news category

So what happened?

Our data reveal a clear connection between the overall decline in engagement with Australian news content on Facebook, and Facebook’s gradual move away from news. Social news outlets in particular have suffered a heavy toll from this change.

In contrast, public service outlets have been more resilient, perhaps because of the high levels of trust Australians place in these outlets. People may have turned to them for reliable information during crises such as Australia’s Black Summer bushfires and the COVID pandemic.

Our data cannot point to one factor that has caused this decline. Instead, we suggest there may be several. Facebook’s algorithm changes would obviously have had an impact; another related factor is that companies are adopting different business strategies and are no longer focused on producing compelling content for Facebook.

It’s also possible Facebook users may be sharing less content overall, and there is also anecdotal evidence of a decline in Facebook use among young Australians.

Whatever the case, it is clear the golden years of Facebook news engagement are over. Indeed, Facebook’s dwindling interest in news was further emphasised by the infamous news blackout in February 2021, during tense negotiations with the federal government over its plan to make tech platforms pay to host news content.

The upshot is that news media outlets can no longer rely on Facebook for easy engagement and audience growth. Whether by choice or necessity, they are already courting readers elsewhere.

James Meese, Research fellow, RMIT University; Edward Hurcombe, Research associate, Queensland University of Technology, and Francesco Bailo, Lecturer, Digital and Social Media, University of Technology Sydney

This article is republished from The Conversation under a Creative Commons license. Read the original article.