Paul Widdop, Manchester Metropolitan University and Simon Chadwick, EM Lyon

Football is changing, again. Many fans who have spent years watching their teams, either live in a stadium or on the television, have long had to face the fact that their teams are (more often than not) no longer owned and run locally.

Russian oligarchs, Gulf nations and Chinese billionaires have regularly bought into European football clubs over the last 20 years. But more recently the money has been flowing across the Atlantic as US private equity firms have seen a lucrative opportunity, caused partly by the pandemic.

This is football like we have never seen it before. Transnational investors – driven by financial returns in a sport fast converging with the entertainment and digital sectors – are transforming the game into a big bucks global industry. Television helped make top football clubs rich, but streaming could bring them untold riches.

COVID-19 didn’t cause football’s private equity boom, but it helped by accelerating and amplifying existing or emerging trends. As football clubs have struggled financially, investors have moved in to pick up some bargains. And as people have stayed at home, so the consumption of streaming services like Netflix and Amazon Prime have become entertainment and lifestyle staples, enhancing the relevance of such platforms for sport.

Who are the investors?

So who are these major American private equity investors taking over European football? Fenway Sports Group (FSG), the owner of English Premier League champions Liverpool, is reportedly on the verge of selling over 10% of the club to US investor RedBird Capital Partners for around £540 million. RedBird appears intent on building a global network of football investments. This would be on the back of the £4.7 million recently invested into the club by basketball superstar Lebron James.

In December, ALK Capital – another American sports investment business – acquired the English club Burnley via a leveraged buyout (similar to how the Glazer family bought Manchester United in 2005). Leveraging essentially means using a club as collateral to secure a loan in order to buy it.

The situation is similar elsewhere. RedBird already holds a stake in French club Toulouse, while Bordeaux (General American Capital Partners and King Street Capital Management) and AS Nancy (New City Capital) are also US-owned. Meanwhile, Troyes FC was bought last year by City Football Group, in which Californian private equity investor Silver Lake owns shares.

The story is the same in Italy, where the Elliott Management Corporation owns AC Milan and where a private equity consortium consisting of CVC Capital Partners, Advent Capital Management and FSI Capital are pursuing the acquisition of a £1.5 billion stake in the new media business of premier league Serie A.

CVC and Advent are reportedly keen on striking a similar deal with German Football’s Bundesliga International, which handles overseas media rights sales.

Network analysis

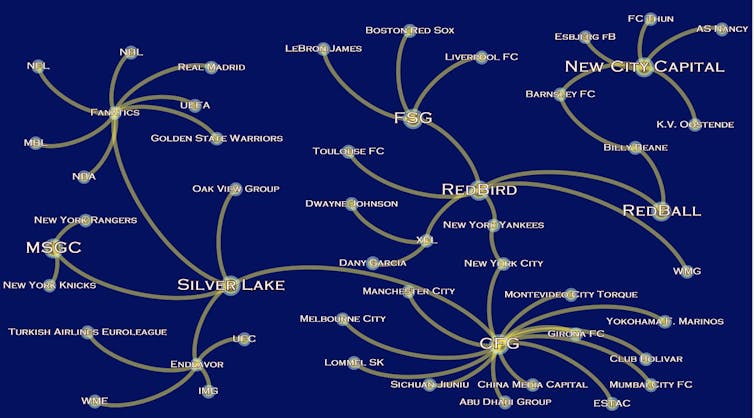

To give a sense of the size and scale of what private equity investors are engaged in and seeking to achieve, we undertook a social network analysis of a small sample of them. Our aim was to highlight the links when we observed two companies sharing an economic relationship. This resulted in the chart below (click to make it bigger).

It is apparent that this private equity investment is not just restricted to Europe or to football. For example, Silver Lake has connections to City Football Group franchises in India, China, Tokyo and Australia. And RedBird’s activities also extend to baseball, through the Boston Red Sox and the New York Yankees.

Such investments are part of broader equity portfolios linked to sports like basketball, American football and wrestling. Silver Lake also appears keen to use football as the means of joining the dots between businesses operating in other sectors such as sports retail (like Fanatics, an online licensed clothing store) and entertainment (such as Endeavour, a talent representation agency).

Blank cheques and streaming

The resurgence of special purpose acquisition companies, or SPACS, has also given rise to a focus on sport. SPACS (like RedBird) are formed specifically to raise capital via initial public offerings (where shares are sold to institutional and retail investors) for the purposes of acquiring or investing in an existing business. They are sometimes referred to as “blank cheque companies” and are focused on making as much money as possible for the investors involved in them.

SPACS and other private equity groups find football very appealing because it is a ready-made product with which people across the world are already engaged. Spectators and fans are willing to pay to watch sport and routinely buy merchandise. So there’s money to be made and investors know it.

But perhaps one of the main reasons these clubs are such a tempting proposition are the opportunities that streaming provides. Consumption habits have changed over the last five years, leading to the consequent erosion of existing broadcasting formats. Over the last two decades, football clubs have benefited from lucrative broadcasting contracts. But the likes of Netflix, Amazon Prime and DAZN promise even greater financial returns, especially for the top clubs playing in the biggest leagues.

These firms can also put clubs in danger. For instance, ALK’s acquisition of Burnley effectively involved mortgaging the club in order to complete its purchase. The club is now £90 million worse off than it was before.

At Manchester United, there has been a long-running fan campaign to remove the Glazers. Even at Liverpool, not everyone is happy with FSG.

That’s because blank cheques off the field don’t necessarily bring blank cheques on the field. Most fans know that investors are interested in one thing: making money. The problem is, maximising profits often means eroding the connections between clubs and the communities in which they are located.

Paul Widdop, Senior Lecturer in Sport Business, Manchester Metropolitan University and Simon Chadwick, Global Professor of Eurasian Sport | Director of Eurasian Sport, EM Lyon

This article is republished from The Conversation under a Creative Commons license. Read the original article.