Steve Schifferes, City, University of London

What a difference a year makes. In March 2020, the chancellor of the exchequer, Rishi Sunak, announced an emergency budget pledging £12 billion to tackle coronavirus. One year later, the government has already spent £280 billion, and spending by spring 2022 will exceed £400 billion.

The 2021 budget – perhaps the most widely leaked in history – contains a cornucopia of short-term measures, such as the extensions to the furlough scheme and to the VAT cuts for hospitality. These are aimed at helping workers and businesses during the transition towards what the prime minister, Boris Johnson, has called “freedom” from lockdown.

There were some future-focused announcements such as the “super-deduction” investment incentives for businesses, visa reforms for highly skilled migrants and the creation of eight new freeport zones. But they will only succeed to the extent that the economy really “bounces back” after the biggest fall in GDP in British economic history. That in turn will have a crucial impact on whether taxes will have to rise further beyond the announcements of a freeze on personal tax bands and sharp increases in corporation taxes for bigger companies, or whether spending might also have to be curbed, to tackle the deficit.

The chancellor’s approach relies on two big gambles: first, that the economy will continue to grow strongly despite the withdrawal of most pandemic financial support from the autumn, a short-term approach questioned by several G7 countries and international financial institutions. And second, that he can fulfil Conservative pledges to “level up” at the same time, amid strong public pressure to tackle inequality and support the NHS. Pulling off these gambles could shape the public finances far more than the tax increases Sunak has proposed so far.

And there is a further gamble: that his long-term vision of an outward-looking, entrepreneurial Britain based on private innovation will be enough to reverse the economy’s long-term weakness after a decade without any increase in productivity or growth in real incomes.

A coiled spring?

The Bank of England’s chief economist, Andy Haldane, argues that the economy will recover rapidly – like a “coiled spring” – once the lockdown is eased, as the richer half of the population, with £125 billion in pent-up savings, rushes out to spend their money.

There is no doubt that there will be a short-term boost to economic growth as businesses shuttered by the lockdown reopen, which both the Bank and the government’s Office for Budgetary Responsibility (OBR) now forecast will be faster than previously thought. The OBR thinks the economy will return to pre-crisis levels by mid-2022, six months ahead of the previous prediction.

But whether this can be maintained depends on whether individuals and firms can put the fears of the pandemic behind them, or continue to be cautious about spending, hiring or investment. Indeed the OBR’s projections suggest growth will be quite weak from 2023 onwards, growing just 1.7% annually, well below Britain’s long-term average.

In addition, even if one section of the population is ready to spend more, there is a very real risk of a K-shaped recovery, where some groups and industries grow much faster than others. This would leave a substantial proportion of the population – the young, the less well educated, and those in deprived communities – seriously affected by the pandemic and without savings. Unemployment is now projected to peak at 6.5% by the end of the year, less than OBR fears of double figures last summer, but there could still be “scarring” of the economy that will permanently damage its potential output.

Such concerns have led the US to embark on the largest economic stimulus package among the G7 countries, 50% bigger than Britain as a proportion of GDP. The US treasury secretary, Janet Yellen, argues that this is only way to kickstart the economy, and has urged much less than the UK in 2020, and is set to recover at a faster pace.

There are admittedly worries that too big a stimulus could stoke inflation, as the former US treasury secretary, Larry Summers, argues. This could lead to higher interest rates on government debt, which could worsen a UK deficit that is forecast to reach a record 17% of GDP this year.

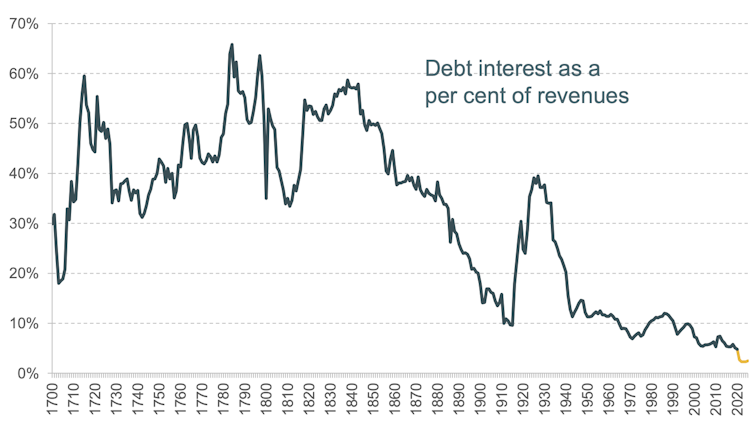

Luckily for the chancellor, ultra-low interest rates have so far meant that the cost of servicing the government’s £2 trillion debt has been smaller than at any time on record. And some inflation would actually help the government both by boosting tax receipts in nominal terms, while cutting the real value of the debt as a percentage of GDP. This is the long-term solution that lowered UK government debt after the world wars.

Cost of servicing public debt

Austerity by stealth?

Although the chancellor has outlined some big tax rises, the government’s aim is not to expand the public sector but to “balance the books”, to show that the Conservatives are fiscally responsible, while reversing the temporary increase in the size of the state.

Sunak has frozen public sector pay and fought hard against any permanent increases in spending, such as in universal benefit, while rejecting calls from NHS hospitals for more funding after the pandemic.

The government’s own November 2020 spending review made it clear that spending by most government departments other than health and defence would fall in future, with further cuts of £4 billion of public spending now planned in future years. The total planned reduction in public spending by £14 billion is the second biggest element in reducing the deficit after corporate tax increases.

Just as the chancellor prefers “stealth taxes” such as changes to income tax bands, he may also decide nearer to the election that this kind of “austerity by stealth” might be a more attractive way to cut the deficit than raising taxes further. Another early example is the squeeze on local government spending, which forces local politicians to raise council tax – for which Sunak may be hoping they will be blamed.

The chancellor is the most popular figure in the cabinet and not shy of self-promotion, as per the video he put out earlier in the week. So far, he has succeeded in appealing to Tory backbenchers who want him to back small business, to the financial markets who want fiscal responsibility, and to the public who want him to tackle inequality. Being able to carry on this balancing act may prove his biggest challenge of all.

Steve Schifferes, Honorary Research Fellow, City Political Economy Research Centre, City, University of London

This article is republished from The Conversation under a Creative Commons license. Read the original article.