Isaac Gross, Monash University

The Reserve Bank of Australia had a Cup Day surprise in store for the country, announcing it was abandoning its policy of “yield curve control”, meaning it was no longer going to defend any particular interest rate for borrowing over any particular duration.

Until today it had a formal target for the three-year bond yield of 0.10%, enabling banks to provide three-year fixed mortgages very cheaply, and indicating the cash rate wouldn’t climb above 0.10% until the most recent three-year bond expires in April 2024.

But it has now abandoned the target, a full two years early.

Why control the yield curve in the first place?

When COVID hit last year, the bank announced it would buy enough government bonds to keep the yield on the three-year bond at 0.25%, as good as guaranteeing money would be cheap for years to come.

Later, it cut the target for three-year bond yields (and the target for its cash rate) to a near-zero 0.10%, further lowering the cost of borrowing.

Responding to an improving economy, the bank decided at its July 2021 meeting not to extend the program bond target beyond April 2024.

The decision created a reasonable expectation the cash rate would remain close to zero until 2024.

What did yield curve control achieve?

Yield curve control achieved a lot. It took the bank just 11 days and A$27 billion dollars of bond purchases to achieve its first target, establishing ultra-low interest rates for years into the future.

After that, it didn’t need to spend much. The new three-year rate became the new norm. Markets believed it would do whatever was needed to defend it.

Over the next 18 months it intervened in the market only occasionally, and only in small amounts. That all changed last week.

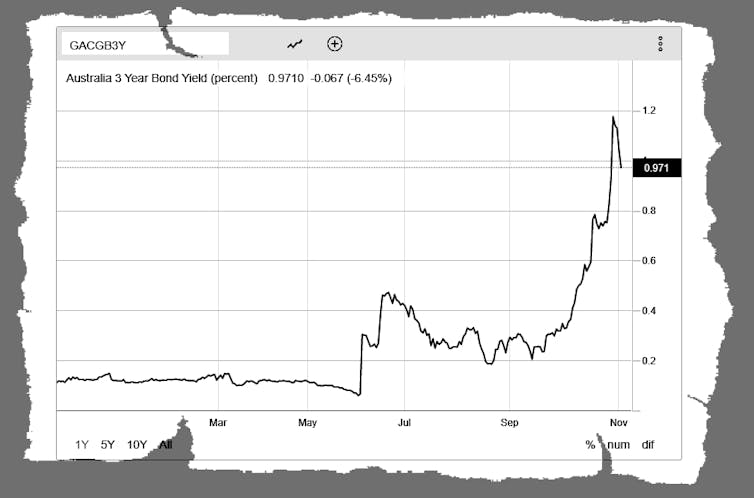

On October 15, the three-year bond rate started to climb above the bank’s target of 0.10%. It initially bought enough bonds to defend the rate and then, without warning, capitulated last Thursday, as good as withdrawing from the market and allowing the rate to climb to a high of 0.70%.

By Monday the rate had climbed to more than 1.00%, more than ten times the Reserve Bank’s target.

Today’s announcement merely made formal what was apparent on Thursday: the bank is no longer going to spend public funds defending a line that might eventually be crossed.

Bond traders thought the improving economic outlook meant the bank would have to lift its record low cash rate sooner that it had said it would. It lost the will to disagree.

In a 4pm press conference Governor Philip Lowe said that to maintain the target would have been untenable. Eventually the bank would have owned all the three-year bonds on offer.

What will this do to the housing market?

Today’s decision is a sure sign interest rates are going to start to rise. Not today, or even for the rest of this year, but sooner was previously expected.

For what it is worth, Lowe said the latest data and forecasts did “not warrant an increase in interest rates in 2022”.

For now, sub-2% fixed-rate mortgages are a thing of the past. The last were withdrawn this week.

The decision means the booming housing market will start to crest. Low interest rates sparked the boom as renters flocked to become first-homebuyers and investors jumped in to catch rising prices.

The prospect of higher mortgage payments is going to dent this enthusiasm, perhaps quickly. Prices are set to stabilise, before edging, or sliding down .

We don’t yet know how quickly variable interest rates will start to rise, but given the Reserve Bank has walked away from a battle to defend yield curve control, we do know it’ll be a long time before it even considers doing it again.

Isaac Gross, Lecturer in Economics, Monash University

This article is republished from The Conversation under a Creative Commons license. Read the original article.